Over the years, the job role of the CFO in organizations has continued to evolve. Depending upon the organizational size, the CFOs are expected to perform more tasks than just the accounting, tax liability, and funding when they are leading a small & mid-sized company. This indeed, adds more business operational responsibilities along with the opportunities.

As a result, they need to play a vital role in accelerating the business growth of their organization and at the same time, maintaining financial sustainability. The changing regulations enable the CFOs to take broader responsibilities beyond the legacy operations. This adds excess challenges while managing the financial operations and some of the key concerns that the CFOs do come across are like:

Challenges

- Too Many Responsibilities (38%)

- Managing the Cash Flow (34%)

- Lack of Accessibility to real-time authentic information (29%)

- Managing the Fast Growth (27%)

- Maintaining the Quality Workforce (25%)

Since the CFOs are accountable for the strategic direction of the company, they are responsible for multiple operations that they need to perform regularly. Some of the key responsibilities are as follows:

Responsibilities

- Forecasting/predictive insights

- Company Budgeting

- Auditing & Reporting

- Strategic Planning

- Working Capital Management

Following to the multi-responsibility roles, CFOs also need to maintain the healthy cash flow in the business by using some smart techniques such as the inclusion of new revenue models, tight budgeting, automated invoicing, and sometimes onboarding a dedicated collections team. To adhere to the responsibilities and to overcome the challenges, the majority of the CFOs prefer to take the help of modern technologies such as the Internet of Things (IoT), Blockchain, Cryptocurrency, Artificial Intelligence (AI) & Machine Learning (ML). The solutions which have a blended combination of the technology and the organizational process adaptability gives the best results for financial operations. As modern enterprise resource planning applications are smartly using the AI & ML platforms, 52% CFOs are preferring the ERP software as the driving force for their organizational growth.

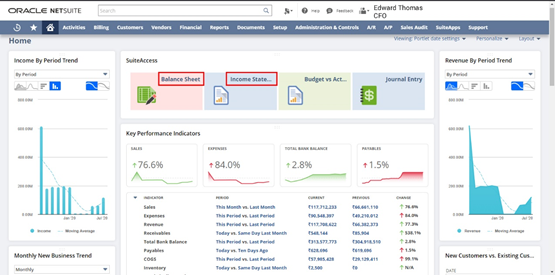

According to the leading CFOs around the globe, the Oracle NetSuite is considered as one of the most trusted Cloud ERP application. Since it provides all the essential finance KPIs such as Day Sales Outstanding, Operating Cash Flow, Revenue, income or sales growth, operating or gross margin, etc. the entire financial aspects of the organizations are completely covered. The common concerns like application security, upfront ROI, system connectivity, business adaptability are eliminated by the NetSuite ERP.

As tops success measures for any CFO are about having the growing revenue, income, and sales along with the operating or gross margin, operating cash flow and customer satisfaction, the constant upgrading technology platforms like Oracle NetSuite benefit the company by achieving these measures. Also, the external challenges such as cyber-attacks, the security of the data, payment fraud, etc. are eliminated by the Oracle NetSuite, helping the CFOs in handling their responsibilities with grace.

Contact us for free ERP consultation & Demo.

Website- https://saturotech.com

Email ID- sales@saturotech.com

Call us on: +91 844-844-8939 and press 3